No matter if you’re a fiscal advisor, investment issuer, or other monetary Specialist, take a look at how SDIRAs may become a robust asset to develop your enterprise and reach your Expert aims.

When you’re seeking a ‘established and ignore’ investing strategy, an SDIRA probably isn’t the right choice. Because you are in full control around every investment built, It is really your decision to carry out your personal homework. Try to remember, SDIRA custodians are certainly not fiduciaries and cannot make tips about investments.

Increased Fees: SDIRAs typically have greater administrative expenditures in comparison with other IRAs, as selected aspects of the administrative procedure can not be automatic.

Before opening an SDIRA, it’s imperative that you weigh the probable advantages and drawbacks depending on your specific money targets and risk tolerance.

As an Trader, nevertheless, your choices aren't restricted to shares and bonds if you choose to self-immediate your retirement accounts. That’s why an SDIRA can transform your portfolio.

Adding funds straight to your account. Understand that contributions are issue to annual IRA contribution limits set with the IRS.

Earning essentially the most of tax-advantaged accounts means that you can keep a lot more of the money that you choose to commit and get paid. Dependant upon whether you end up picking a traditional self-directed IRA or maybe a self-directed Roth IRA, you've the likely for tax-free or tax-deferred progress, supplied specified problems are satisfied.

IRAs held at banks and brokerage firms present constrained investment options to their shoppers simply because they do not need the know-how or infrastructure to administer alternative browse around this site assets.

Set only, if you’re looking for a tax economical way to develop a portfolio that’s far more tailor-made for your pursuits and abilities, an SDIRA can be The solution.

Variety of Investment Choices: Make sure the provider lets the types of alternative investments you’re serious about, including housing, precious metals, or personal fairness.

Minimal Liquidity: Lots of the alternative assets that could be held in an SDIRA, for example real-estate, private fairness, or precious metals, is probably not quickly liquidated. This can be an issue if you have to obtain resources speedily.

Feel your Buddy might be starting off the following Fb or Uber? Using an SDIRA, you are able to spend money on triggers that you suspect in; and perhaps delight in better returns.

Lots of traders are stunned to understand that making use of retirement money to invest in alternative assets has become possible considering that 1974. Nonetheless, most brokerage firms and financial institutions focus on supplying publicly traded securities, like stocks and bonds, as they deficiency the infrastructure and expertise to manage privately held assets, like real-estate or personal equity.

Be in charge of the way you grow your retirement portfolio by utilizing your specialised awareness and pursuits to take a position in assets that in shape with the values. Obtained abilities in real estate property or personal equity? Utilize it to guidance your retirement planning.

Complexity and Duty: With an SDIRA, you may have a lot more control in excess of your investments, but Additionally you bear extra duty.

Shopper Assist: Try to find a service provider that provides committed help, including entry to professional specialists who can answer questions on compliance and IRS policies.

Simplicity of use and Technological innovation: A user-pleasant System with online equipment to trace your investments, submit paperwork, and take care of your account is essential.

Entrust can help you in acquiring alternative investments using your retirement cash, and administer the acquiring and marketing of assets that are generally unavailable by way of banks and brokerage firms.

Real estate is one of the preferred solutions between SDIRA holders. That’s simply because you may invest in any type of real estate property which has a self-directed IRA.

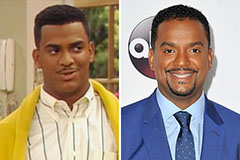

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now!